Related: Our pizza didn’t taste good, Domino’s says in new ads

It did if you liked the taste and texture of cardboard.

And I wouldn't be calling in an order anytime soon, kids:

"No more free pizza offers on campus; New limits on credit card firms take effect in Feb." by Shaila Dani, Associated Press | January 10, 2010

NEW YORK - “I thought, ‘Free pizza? Good deal,’ ’’ he says. But when he got to the Papa John’s, he met an obstacle. He had to fill out a credit card application on one of four computers set up for that purpose before he could get his free slice. “They didn’t actually let you know that until you got there,’’ he says. Merki typed in some fake information and got his free food. He’s now a junior and does not have a credit card - and he says that’s fine with him.

Andrew Merki, who’s chairman of student consumer advocacy organization the Indiana Public Interest Research Group, managed to beat the system. But many other students have followed through with such marketing lures to become new credit card holders.

Come Feb. 22, college students won’t be tempted with free pizza and other goodies to sign up for credit cards. That’s when new marketing restrictions and other rules take effect, and the end result should be fewer plastic-driven shopping sprees for consumers below the age of 21.

The average college senior was saddled with credit card debt of $4,100 in 2008, up from $2,900 in 2004, according to a Sallie Mae survey.

Related: Student Loan Scam

Sweet Sallie Mae Back in United States

(sound of credit card swipe)

Credit card companies expect young consumers to stay loyal to the first credit card brands that make it into their wallets. The card issuers sometimes get information on students directly from colleges, for a fee.

Where is YOUR KICKBACK, student?

College is MAKING MONEY of YOUR NAME by selling it to CREDIT CARD COMPANIES?

SCHOOLS are NOT REALLY ABOUT YOU, are they, kids?

I'm glad I'm long done.

Students can end up with cards with very high interest rates or big fees that can make it easy to accumulate a mountain of debt.

That is the point. Debt slavery for life.

The average college student is already awash in credit. Most have four or more cards, and only 17 percent said they always pay off their full balances every month, according to Sallie Mae.

How about one?

Of course, many students use credit cards responsibly....

Then I won't worry.

Americans under the age of 21 will be required to prove they have a source of income to pay off any charges, or will need to get a cosigner before they can get a card.

But banks just get tax loot tossed at them?

The new rule gives parents a chance to say “no’’ and teach kids a lesson about money, spending, and personal responsibility, says Susan Beacham, chief executive of Money Savvy Generation, which educates parents on how to talk to their kids about money.

Related: Going Xmas Shopping: Inside the Mall

How come no one ever says that to looting banks, war profiteers, or Israel?

A cosigner is “agreeing to take personal responsibility for the debt the child incurs,’’ notes Beacham. That means the cosigner’s credit score can get dinged if the cardholder does not pay his or her bills on time. “We don’t need to do that to ourselves or give our children that ability,’’ she says.

Why? You don't like fighting at home?

Gail Hillebrand, senior attorney for the nonprofit advocacy group Consumers Union, publisher of Consumer Reports magazine, says she’s concerned students will ask older friends or romantic partners to cosign for them. “Even for adults, it’s hard to understand that a single mistake can stay on your credit for seven years,’’ she says, noting that a low credit score can make it more expensive - or impossible - to get a loan. “They could sign away their futures.’’

Why not? Already sold the soul to the devil, so....

As an alternative, parents can set up checking accounts for their kids, or get them a debit card tied to a prefunded account. Once the young adult has demonstrated that he or she can be responsible with money, credit card talks can begin.

So WHAT do we do with an OUT-of-CONTROL GOVERNMENT?

Then there is the argument that an 18-year-old needs a credit card to build up his or her credit history, in order to qualify for loans in the future.

Oh, yeah, I remember that deal.

No credit history, can't give you a loan.

How do I get credit history?

Take out a loan.

Consumer advocates say it’s fine to wait, because it takes just six months to a year of credit card usage to build up enough history to develop a score.

Unless you are a bank, war-loo.... you know.

“There is plenty of time to do that,’’ says Hillebrand. “It’s better to have a thin credit record than a crushing debt load.’’

--more--"I wouldn't worry too much about that:

Rules tightened for getting store credit card

Consumers will have to divulge more personal information to apply for store credit cards - possibly putting the brakes on so-called instant credit - under sweeping industry reforms made final Tuesday by the Federal Reserve.Typically, retailers quickly approve new accounts based on customers’ credit scores. The new regulations require that they also consider shoppers’ income and assets.

“Consumers are not going to want to have that conversation,’’ said Mallory Duncan, a lobbyist for the National Retail Federation, a trade group."

And I won't.

And for after the pizza:

H:

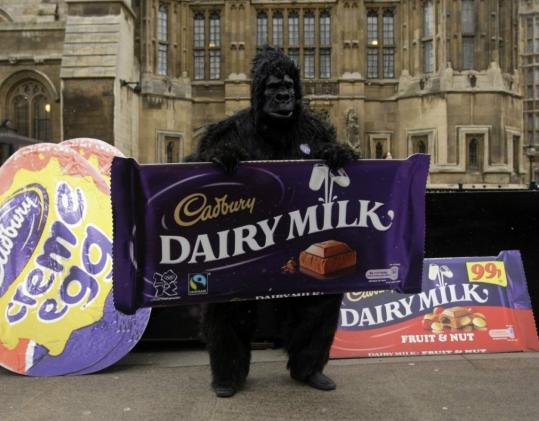

A demonstrator dressed as a gorilla protested against the possible sale of the Cadbury chocolate company outside the Houses of Parliament in London in December. (Matt Dunham/ Associated Press)

Hershey still sweet on Cadbury deal

Hey, everyone knows how much the kids like chocolate.